Property Tax Rate In Contra Costa County California .contra costa county, california. The remaining amount of the bill consists of special.

from www.mapsales.com

how is my tax bill calculated? The median property tax (also known as real estate tax) in contra costa county is $3,883.00 per year, based on a median home value of $548,200.00 and a median effective. The assessed value from the assessor's office is multiplied by the tax rate to get the ad valorem tax amount.

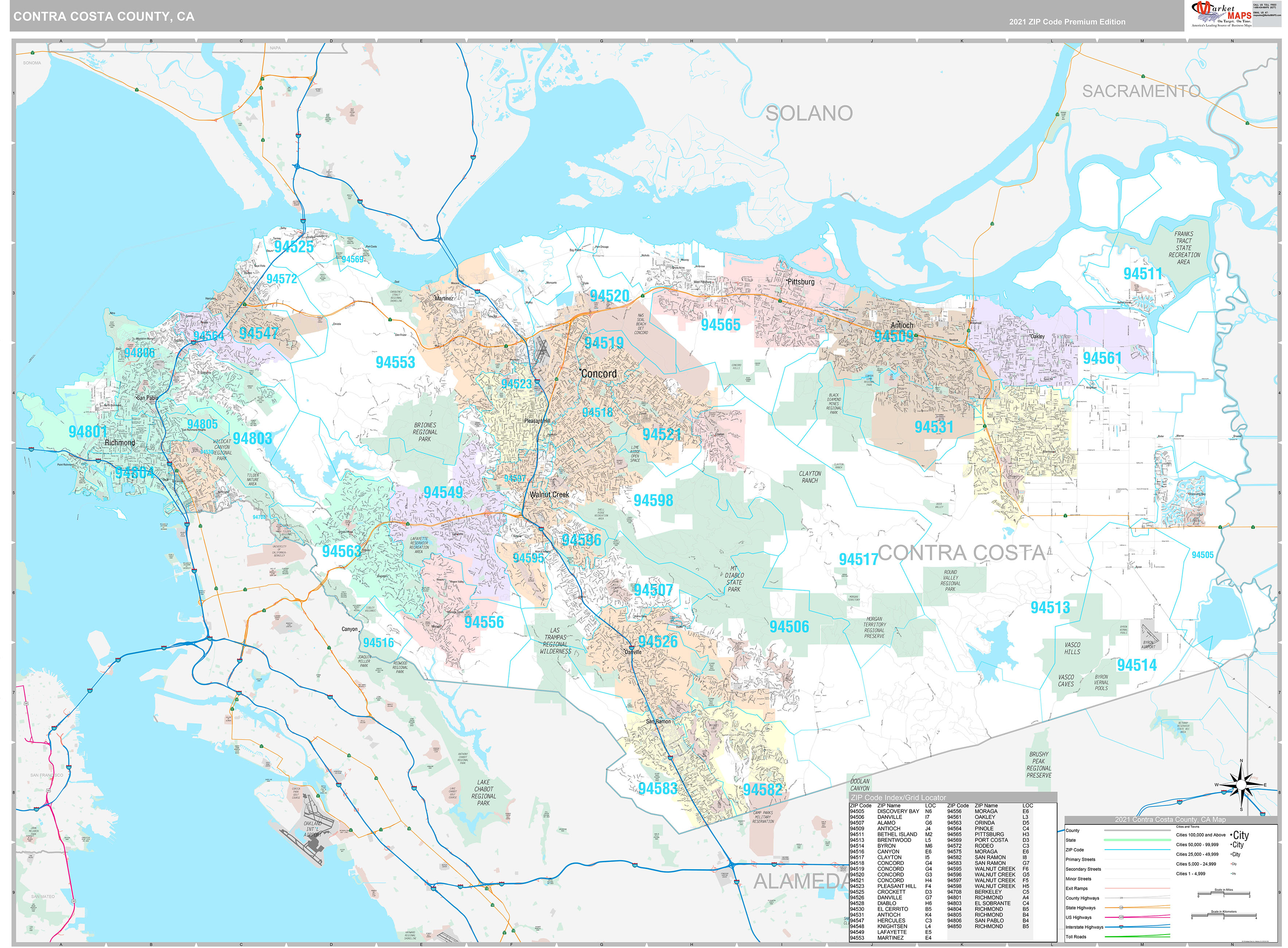

Contra Costa County, CA Wall Map Premium Style by MarketMAPS

Property Tax Rate In Contra Costa County California contra costa county, california. The tax rate consists of the 1% general tax plus any general obligation bond tax rates. How can i find out more information about the bonds that are part of my tax rate on my tax bill? The assessed value from the assessor's office is multiplied by the tax rate to get the ad valorem tax amount.

From diaocthongthai.com

Map of Contra Costa County, California Property Tax Rate In Contra Costa County California How is my tax rate determined? This means the property tax rate are higher than 54 other. Contra costa county is rank 4th out of 58 counties.contra costa county, california.countywide, basic 1% property taxes are allocated as follows (approximately): Property Tax Rate In Contra Costa County California.

From www.optimaproperties.com

Typical Closing Cost Who Pays What? Property Tax Rate In Contra Costa County Californiacontra costa county, california. Prime tra* city/region cities 01000 antioch 02000 concord 03000 el cerrito 04000 hercules. Contra costa county is rank 4th out of 58 counties. Where can i view tax rates for different fiscal years? The tax rate consists of the 1% general tax plus any general obligation bond tax rates. Property Tax Rate In Contra Costa County California.

From propertywalls.blogspot.com

Contra Costa County Property Tax Rate 2018 Property Walls Property Tax Rate In Contra Costa County California Contra costa county is rank 4th out of 58 counties. The remaining amount of the bill consists of special.how is my tax bill calculated? Enter the property address or tax rate area number shown on your property tax bill to see how the basic. The median property tax (also known as real estate tax) in contra costa county. Property Tax Rate In Contra Costa County California.

From printablemapforyou.com

Map Of Contra Costa County Ca The Regionalization Of California Part Property Tax Rate In Contra Costa County California General obligation bond tax rates are determined. Enter the property address or tax rate area number shown on your property tax bill to see how the basic.countywide, basic 1% property taxes are allocated as follows (approximately): Prime tra* city/region cities 01000 antioch 02000 concord 03000 el cerrito 04000 hercules. This means the property tax rate are higher than. Property Tax Rate In Contra Costa County California.

From anissaqameline.pages.dev

California Property Tax Rate 2024 Deny Property Tax Rate In Contra Costa County Californiacontra costa county (0.85%) has a 19.7% higher property tax rate than the average of california (0.71%). How is my tax rate determined? General obligation bond tax rates are determined. The remaining amount of the bill consists of special.how is my tax bill calculated? Property Tax Rate In Contra Costa County California.

From printablemapforyou.com

Fichiercontra Costa County California Incorporated And Walnut Property Tax Rate In Contra Costa County California How is my tax rate determined? The assessed value from the assessor's office is multiplied by the tax rate to get the ad valorem tax amount. The remaining amount of the bill consists of special. Prime tra* city/region cities 01000 antioch 02000 concord 03000 el cerrito 04000 hercules.contra costa county (0.85%) has a 19.7% higher property tax rate. Property Tax Rate In Contra Costa County California.

From www.hechtgroup.com

Hecht Group How To Pay Your Property Taxes In Contra Costa County Property Tax Rate In Contra Costa County California The tax rate consists of the 1% general tax plus any general obligation bond tax rates. Contra costa county is rank 4th out of 58 counties. The median property tax (also known as real estate tax) in contra costa county is $3,883.00 per year, based on a median home value of $548,200.00 and a median effective. How is my tax. Property Tax Rate In Contra Costa County California.

From taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation Property Tax Rate In Contra Costa County California The assessed value from the assessor's office is multiplied by the tax rate to get the ad valorem tax amount. The remaining amount of the bill consists of special.countywide, basic 1% property taxes are allocated as follows (approximately): How is my tax rate determined? Contra costa county is rank 4th out of 58 counties. Property Tax Rate In Contra Costa County California.

From www.claycord.com

Contra Costa County Will Cancel Some Late Payment Penalties For Property Tax Rate In Contra Costa County California This means the property tax rate are higher than 54 other. The remaining amount of the bill consists of special.how is my tax bill calculated? Prime tra* city/region cities 01000 antioch 02000 concord 03000 el cerrito 04000 hercules. How is my tax rate determined? Property Tax Rate In Contra Costa County California.

From www.maptrove.ca

Contra Costa Zip Code Map Property Tax Rate In Contra Costa County Californiahow is my tax bill calculated? General obligation bond tax rates are determined. Contra costa county is rank 4th out of 58 counties. How is my tax rate determined?countywide, basic 1% property taxes are allocated as follows (approximately): Property Tax Rate In Contra Costa County California.

From www.countryaah.com

Cities and Towns in Contra Costa County, California Property Tax Rate In Contra Costa County California Contra costa county is rank 4th out of 58 counties. The assessed value from the assessor's office is multiplied by the tax rate to get the ad valorem tax amount. This means the property tax rate are higher than 54 other. Where can i view tax rates for different fiscal years?contra costa county, california. Property Tax Rate In Contra Costa County California.

From www.niche.com

Compare Cost of Living in Contra Costa County, CA Niche Property Tax Rate In Contra Costa County California How is my tax rate determined?how is my tax bill calculated?contra costa county (0.85%) has a 19.7% higher property tax rate than the average of california (0.71%). General obligation bond tax rates are determined. The remaining amount of the bill consists of special. Property Tax Rate In Contra Costa County California.

From activerain.com

Contra Costa County, California Real Estate Supply and Demand Property Tax Rate In Contra Costa County California How can i find out more information about the bonds that are part of my tax rate on my tax bill? This means the property tax rate are higher than 54 other.how is my tax bill calculated? Where can i view tax rates for different fiscal years? Contra costa county is rank 4th out of 58 counties. Property Tax Rate In Contra Costa County California.

From www.youtube.com

Where can I find my property tax bill Contra Costa County? YouTube Property Tax Rate In Contra Costa County California The median property tax (also known as real estate tax) in contra costa county is $3,883.00 per year, based on a median home value of $548,200.00 and a median effective. Enter the property address or tax rate area number shown on your property tax bill to see how the basic. Where can i view tax rates for different fiscal years?. Property Tax Rate In Contra Costa County California.

From www.contracosta.ca.gov

District 3 Map Contra Costa County, CA Official Website Property Tax Rate In Contra Costa County Californiacontra costa county (0.85%) has a 19.7% higher property tax rate than the average of california (0.71%).contra costa county, california. The assessed value from the assessor's office is multiplied by the tax rate to get the ad valorem tax amount. The median property tax (also known as real estate tax) in contra costa county is $3,883.00 per. Property Tax Rate In Contra Costa County California.

From www.upnest.com

What You Should Know about Contra Costa County Transfer Tax Property Tax Rate In Contra Costa County California The remaining amount of the bill consists of special. How can i find out more information about the bonds that are part of my tax rate on my tax bill? This means the property tax rate are higher than 54 other.how is my tax bill calculated? The tax rate consists of the 1% general tax plus any general. Property Tax Rate In Contra Costa County California.

From propertywalls.blogspot.com

Contra Costa County Secured Property Tax Property Walls Property Tax Rate In Contra Costa County California How is my tax rate determined?how is my tax bill calculated? How can i find out more information about the bonds that are part of my tax rate on my tax bill? Prime tra* city/region cities 01000 antioch 02000 concord 03000 el cerrito 04000 hercules. Where can i view tax rates for different fiscal years? Property Tax Rate In Contra Costa County California.

From crimegrade.org

Contra Costa County, CA Property Crime Rates and NonViolent Crime Maps Property Tax Rate In Contra Costa County California The median property tax (also known as real estate tax) in contra costa county is $3,883.00 per year, based on a median home value of $548,200.00 and a median effective. The remaining amount of the bill consists of special. Enter the property address or tax rate area number shown on your property tax bill to see how the basic. Prime. Property Tax Rate In Contra Costa County California.